Hello … From the Trenches

I’ve spent the last many months reviewing the data from our 3rd Annual Finance Technology Survey. We’re preparing the full survey report and hope to release it in the October timeframe – stay tuned!

In the back of my mind, I’ve been writing this and thinking about a series of blogs to trumpet the arrival of the 3rd Annual Finance Technology report. Funny thing, though, I’ve been heads down in the survey data all this time – and it’s already past Labor Day! And it’s time to get out this first blog before diving back into the research.

As for the results, well, there’s so much I want to share. While many points of interest have been popping up, 3 key items stand out to me when all is said and done. In the following sections, I offer you a brief glimpse into a few of the insights we’ll soon be publishing.

SaaS for Finance Applications

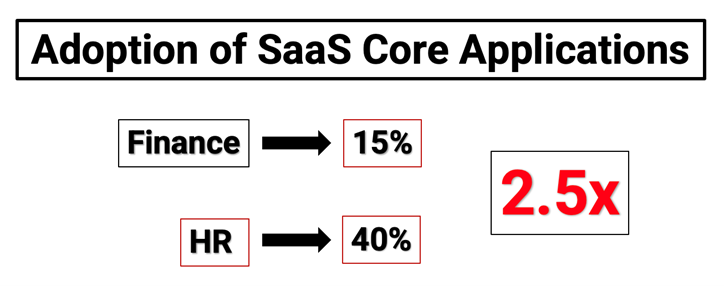

First, and in no particular order, we discovered that only 15% of organizations reported running their finance applications using a SaaS[1] model. I was surprised, given that 40% of HR organizations which participated in the 24th Sapient Insights Annual HR Technology Research[2] reported running their HR applications using a SaaS model. The HR rate of SaaS adoption is nearly 2.5 times that of finance organizations.

However, I wasn’t totally surprised. As a former practitioner with responsibilities for both global HR and finance systems, I found that HR cloud technology was further ahead in terms of the SaaS maturity curve – both in intelligent toolset adoption (e.g., RPA[3], machine learning, etc.) and in the ability to meet global business requirements.

Not only do I believe HR vendors have led the race to acceptable SaaS solutions, but also that finance vendors have faced greater challenges with SaaS adoption, given the more stringent regulatory requirements of the finance function (e.g., IFRS, GaaP, etc). In addition, the implications of a failed finance implementation – verses that of an HR implementation – typically can be substantially more costly and impactful. I’ve observed in the survey data a slight uptick in future finance SaaS adoption, but more about that in our soon-to-be-released report.

Cost: A Roadblock to SaaS for Some

Second item is this: Small organizations (less than $50 million in revenue) and medium organizations (less than $1 billion in revenue) reported cost as a major inhibitor to finance SaaS adoption. Again, not a total surprise to me.

As a practitioner, generally, I find that vendors struggle with their pricing models for SaaS HCM, finance ERP, and others to appropriately size themselves to the small and medium organizations. It seems that, for example, if you’re a firm with more than 50,000 employees and/or revenue well north of a billion dollars, then the SaaS model has been easier to adopt from an affordability perspective.

While I have experienced a little more flexibility in SaaS pricing within the last couple of years, this hopefully can lead to greater affordability for and adoption of finance SaaS solutions.

PaaS and SaaS

Third thing I noted is that 36% of all organizations reported adopting PaaS[4] (platform as a service). That total fell slightly below my expectations, given that SaaS solutions, by definition, are driven by configuration and not customizations.

Organizations, especially those with long established processes, may find themselves requiring to maintain a key business process(es) that’s not found in their SaaS solution. So, PaaS provides that capability needed to close the gap created by SaaS adoption.

PaaS, on the other hand, may:

- Require additional annual subscription fees

- Require the system support team to learn new technology

- Need to be considered with the regularly scheduled updates delivered with the SaaS subscription

Also, those considering adopting finance SaaS solutions should factor in the possible cost of PaaS during their planning. Just some sage advice.

Final Thoughts

I hope you’ve been able to glean something of use from these 3 findings I’ve shared. Remember: Keep an eye out for the full report, which’ll be released in the coming weeks.

Also, you can sign up to receive the report when it’s published – definitely easier than trying to remember.

You can visit us any time at Sapient Insights Group or email us to discover how we can help you realize the success you seek.

–

[1] Software as a service (SaaS) is an application that’s hosted by a third-party provider and delivered to customers over the internet as a service. SaaS applications are typically accessed via web browsers, with SaaS as 1 of 3 main categories of cloud computing, alongside infrastructure as a service (IaaS) and platform as a service (PaaS).

[2] Sapient Insights 2021-2022 HR Systems Research, 24th Annual Edition, Sapient Insights Group / Stacey Harris, Sheryl Herle & Kimberly Fletcher, 2021.

[3] RPA stands for robotic process automation.

[4] Platform as a service (PaaS) is a cloud computing model which provides customers with a complete cloud platform – hardware, software, and infrastructure – for developing, running, managing and extending applications without the cost, complexity, inflexibility, or need for additional resources that often come with building and maintaining such a platform on-premises.